It’s time to get the simple, indisputable facts about the growing chances for flooding in Hampton Roads and why you need flood insurance.

Why do you need flood insurance?

Sure, many homes and families in Hampton Roads have yet to experience flooding. If you haven’t had water where it’s not supposed to be, you’ve been lucky. But times, as they say, are a’changin. And the facts are the facts. Here goes…

Floods are the most common natural hazards.1

And we’re not alone – 90 percent of all natural disasters in the U.S. involve some type of flooding.2 But not every flood is catastrophic. Smaller, more frequent flooding degrades infrastructure and can damage roads and building foundations over time. Communities suffer school closures, traffic interruptions, and continuing cost and inconvenience due to this “nuisance flooding.” Degraded sewer infrastructure results in heightened public health risks.3 And on it goes…

Anywhere it can rain, it can flood. Period.

High-risk areas, including parts of Hampton Roads, have a one-in-four chance of experiencing a flood over the life of a 30-year mortgage.1 Heavy rainfall events have become more intense and frequent in our area and will only continue to increase.2 Based on previous records, it is also likely that water levels will be higher than the average daily high tide when a rainfall event occurs.3

Floods can come from overflowing or accumulating waters, which can be caused by rainfall.

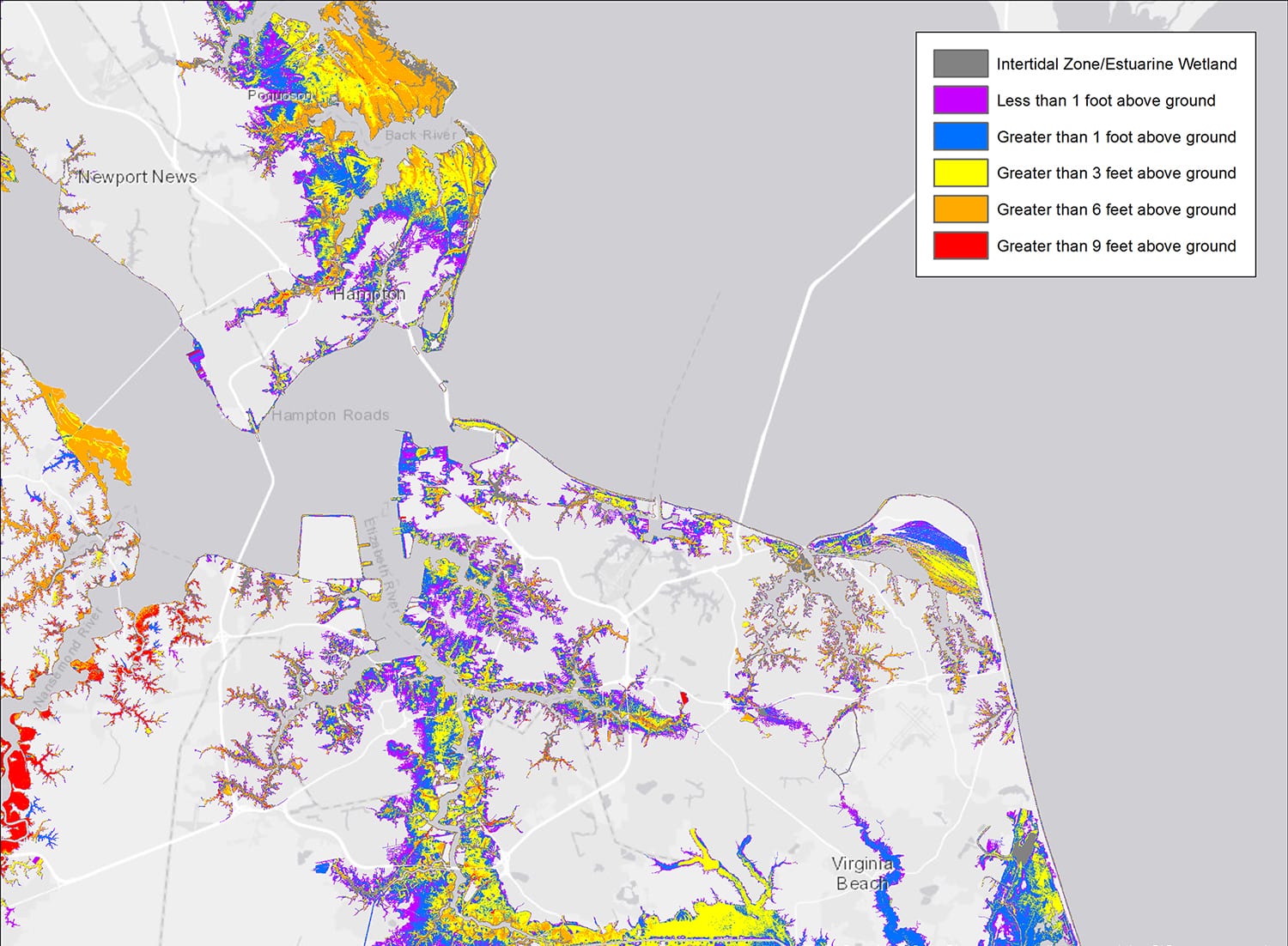

There are many causes of flooding here in Hampton Roads, and rainfall is one of them. Another is storm surge. Did you know that Hampton Roads has so many houses at risk of storm surge that a real estate data firm says that only four other regions in the country are more vulnerable?1 But remember, it doesn’t need to be raining to flood. Nuisance or “sunny day” flooding can be caused by high tide and the direction the wind is blowing.

Water, water, everywhere…

Waterways permeate every corner of Hampton Roads, making it especially susceptible to flooding.

Water, water, everywhere…

Waterways permeate every corner of Hampton Roads, making it especially susceptible to flooding.

Low-risk does NOT mean no-risk.

Statistics show that people who live outside high-risk areas file more than 25 percent of flood claims nationwide.1 Take, for example, the devastation of Hurricane Matthew in October 2016; of the Hampton Roads households that were impacted, 84% were outside high-risk mapped flood zones.2

Are you willing to risk your home and its contents? Use our handy Flood Insurance Estimator to get a quick estimate of what your flood insurance rate might be.

Homeowners and renters insurance does NOT cover flood damage.

Fifty-six percent of homeowners with homeowners insurance believe their policy covers flood insurance.1 If you are unsure, check with your agent. You can also use our special Flood Insurance Estimator to get a quick estimate of what your flood insurance rate might be.

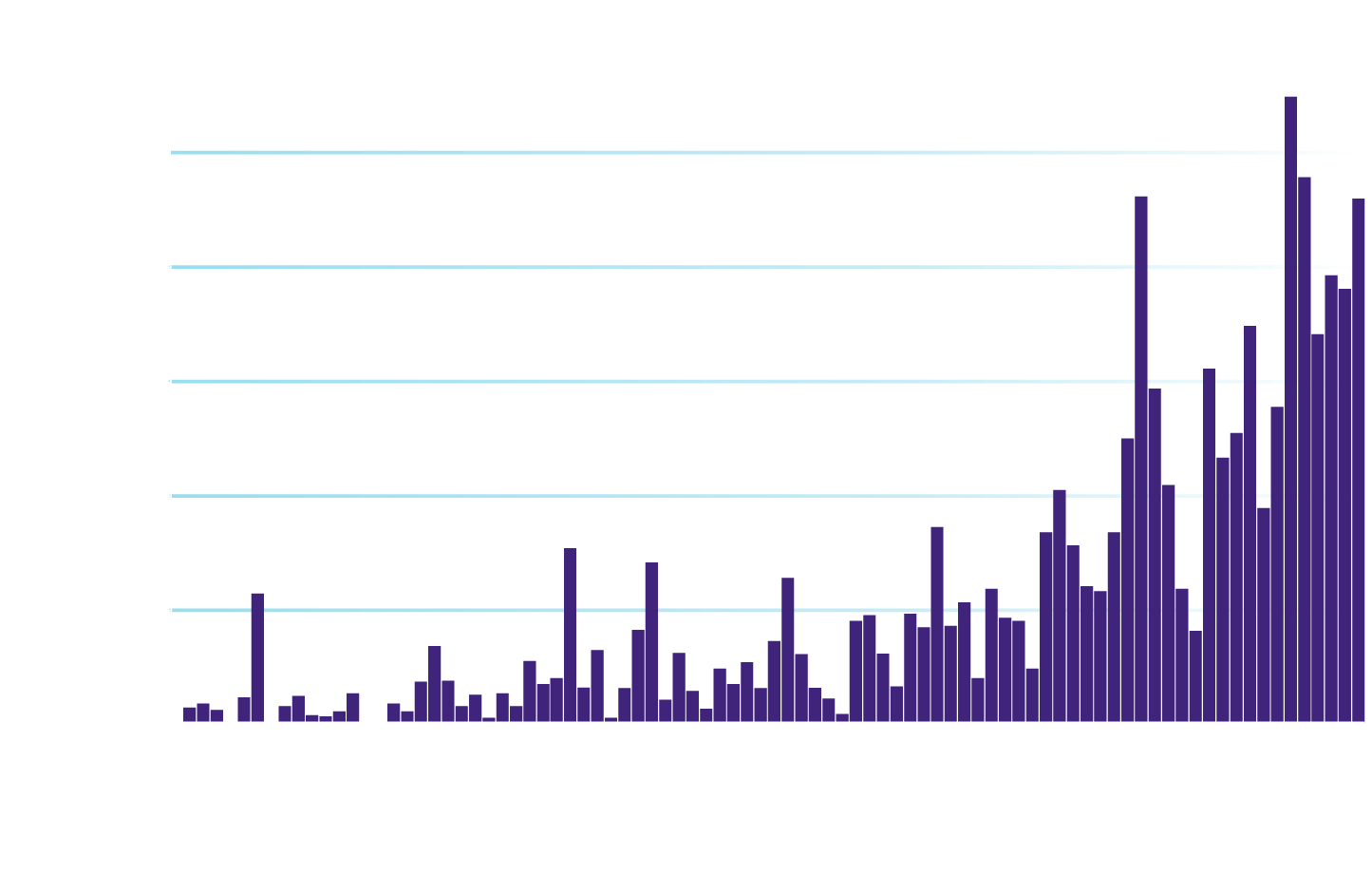

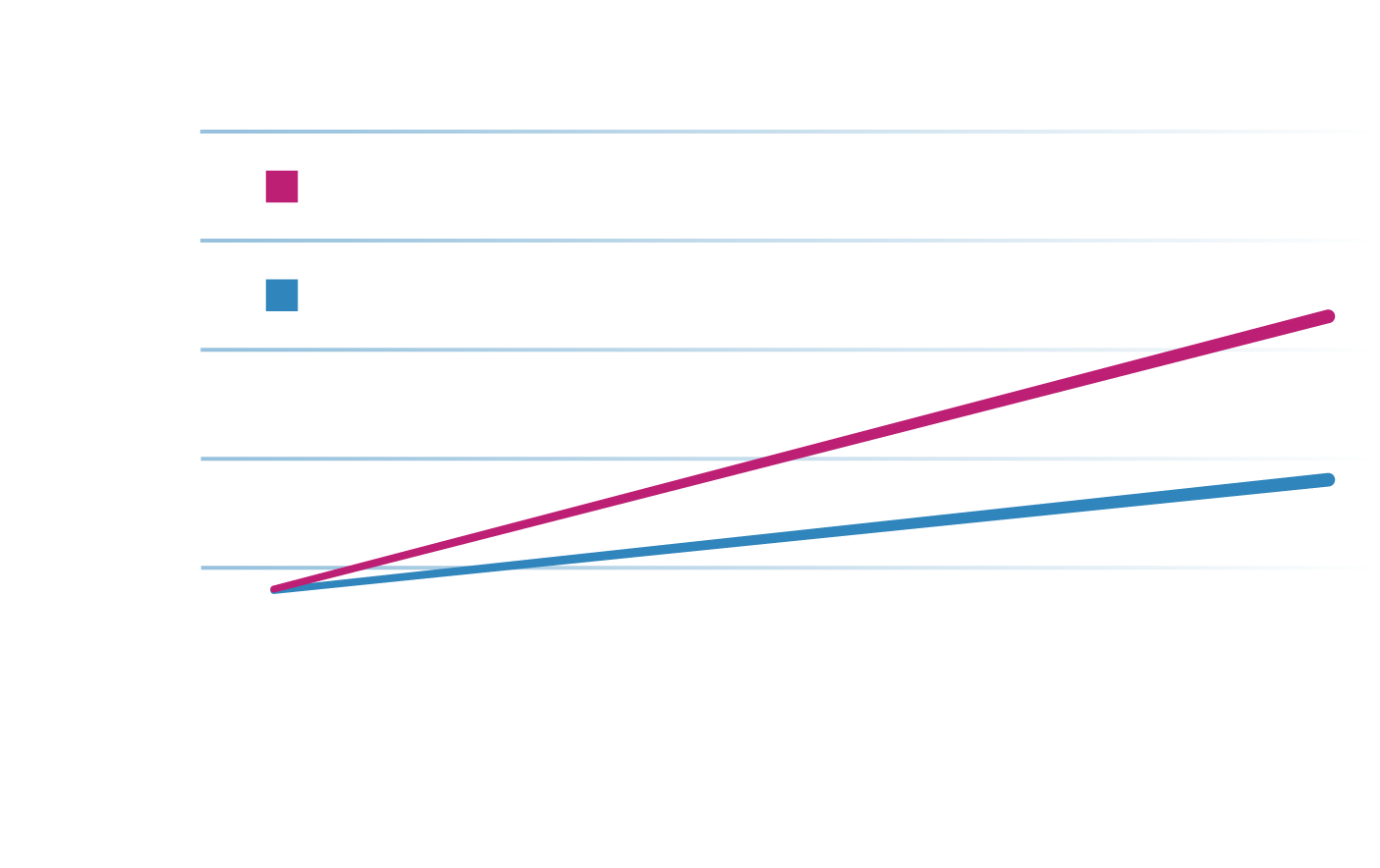

The total annual rainfall in our area has trended up over the past 70 years from about 43 inches to nearly 50 inches.1

In Hampton Roads, we are surrounded by water.

No matter where you are in Hampton Roads, it would only take about 15 minutes to walk to a stream, river or body of water that flows into the Chesapeake Bay.1

We live just a few feet above sea level.

We’re so fortunate to be living in beautiful Hampton Roads. But sometimes, all the water that’s a tremendous source of business and pleasure here in coastal Virginia can become a big problem. But this is not just about whether you live on or near the water (the oceanfront or the bay, near a river or lake) or even if your neighborhood’s already experienced flooding from overwhelmed drainage systems or not. This is about the fact that if you live in Hampton Roads, you are at risk of flooding.

Risk of Storm Surge

With so much water and such low ground, Hampton Roads is especially vulnerable to storm surge, the abnormal rise in seawater level during a storm caused primarily by winds pushing water onshore. Even “low risk” areas are at substantial risk of flooding during large storms.

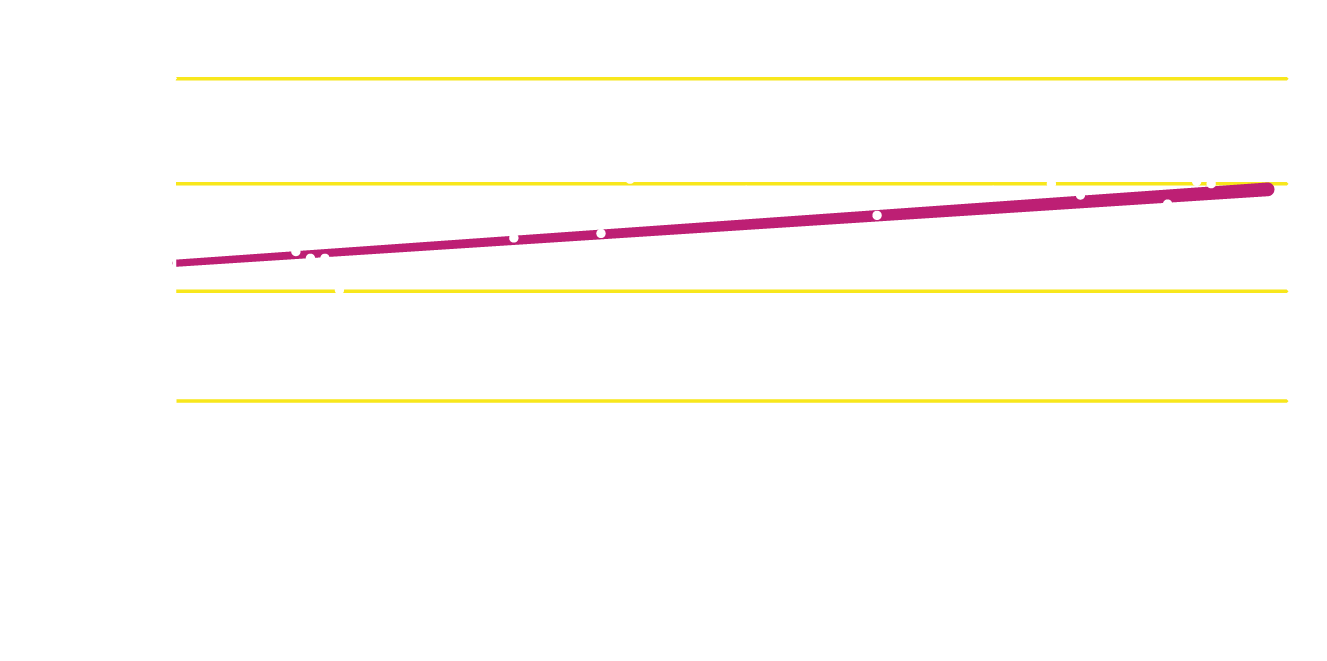

Our sea level is rising.

In Hampton Roads, the sea is rising by one inch every five years; in the last 25 years, sea level has risen here by over 5 inches.1 Scientists now forecast that in the next 30 years, sea level will rise by over a foot.2 Doesn’t sound like much? Consider this… Norfolk is flooding nearly twice as much now as in 2000 due to less than five inches of sea level rise.3

Hampton Roads is sinking.

Not only is the sea level rising in Hampton Roads, but the ground here is also sinking. An extra inch or two every twenty years may not sound like much1 , but that’s the reason Hampton Roads is experiencing the highest rate of sea level rise on the East Coast. It’s a one-two punch combination that floods will increasingly affect more territory and homes in our region’s cities, even during high-tide events without major storms.2

Flood insurance pays whether or not federal disaster assistance is available.

Federal disaster assistance is only available after a Presidential Disaster Declaration.1 What’s more, even if a Presidential Disaster Declaration2 has been made, the money offered through disaster assistance is typically a low-interest loan that will need to be paid back, and if you do qualify for a grant, it will most likely provide much less than you would need to recover.3 The fact is, while the maximum amount FEMA can grant is $30,000, the average payout for Hurricane Sandy was $8,016.4

Use our Flood Insurance Estimator for a quick estimate of what your flood insurance rate might be and see how that compares to what you might have to pay out if you didn’t have flood insurance.